My Husband Passed Away Owing Bills

Money, Credit and Debt Advice – Get Out of Debt Guy

Question: My Husband Passed Away With Bills

Dear Steve,

My husband passed away a few years ago. A couple of years ago I had a couple of strokes and I really have a hard time remembering things.

I know there were a couples of bills but I can’t find the right paperwork but a collector is trying to get me to pay. I think these were charge cards. Can I be hounded for these debts? What can I do? I have COPD and other stuff that any older American would never want to have but we can’t always pick our illness.

Sally

Answer:

Dear Sally,

I’m so sorry to hear about the loss of your husband. When one spouse dies it can cause a great disruption of the family finances, especially if the finances were typically managed by said spouse.

Your situation is even more difficult because you have had your own medical issues that make it hard to remember and deal with the bills.

Hopefully you have someone you can really trust to give you a hand with this situation. It’s going to take just a bit of work and organization but I think you can get this resolved in a positive way.

There is detailed information about how to deal with bills after the death of a loved one. You can find the full article here but here are some highlights.

When one spouse dies the other should notify the creditors soon after by sending them an original copy of the death certificate and letting them know the person passed away. This is why it is good to have a number of original copies of the death certificate on hand.

Some creditors will check the Social Security death notifications and find out before you contact them but don’t count on that.

If the debt was only in the name of the spouse that passed away, the creditor would have to look to the estate for any compensation. If there was none, the debt ends there.

Unfortunately, not every situation is clear cut. Community property states and other issues can complicate things.

Even if you did everything right, it is not unusual for a collector to surface years later and attempt to collect an old debt. Just because a collector is trying to collect, does not mean it is a valid debt to be paid.

Before you agree to pay any old debt you should ask the debt collector to prove the debt is legitimate. With the buying and selling of old debts, the proof that the debt is valid often vanishes along the way. Without that proof the debt collector may not have the right to collect any money from you. There are some simple letters you can send to the debt collector to ask them to prove the validity of the debt. See this article or have a friend help you to send one of these letters.

I realize this situation may be confusing, especially with your memory issues, but don’t panic and certainly don’t make any promise to pay the old debt before we can identify that the debt warrants payment.

It is very frustrating that so many older people who struggle with other issues find themselves paying back money claimed to be owed by debt collectors. Paying back debts you don’t owe simply robs you of the limited money you have on hand.

Each state has a specific statute of limitations. This means after a certain period of time the creditor could not legally sue you over an old expired debt. However, collectors do it all the time because consumers rarely fight back so the creditor wins by default. I would urge you to discuss your specific situation with a lawyer licensed in your state.

Speaking of the law, if you have little left in the way of assets and no money to pay these debts, you may be what people typically call judgment proof. That means you could be sued over the old debts if they are valid and still enforceable, but if you have limited income and assets the creditor may not be able to collect even if they did win in court.

![]()

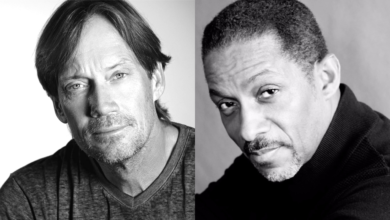

Get Out of Debt Guy – Twitter, G+, Facebook

Steve Rhode is the Get Out of Debt Guy. He’s been helping people with personal finance troubles through advice and education since 1994. If you would like to ask a question you can visit this link and let Steve help you for free.

If your publication would like to publish this column, click here.